Home > E-Banking > Telephone Banking

Loss Reporting Business

2011-08-03

In order to guarantee the safety of depositors’ funds timely, 95313 hotline provides the service of account loss reporting and stop payment.

Service Content

The loss reporting function of telephone banking provides services to all individual clients. After dialing in 95313, clients can complete the loss reporting operation by typing relevant information according to the guidance of self-service voice.

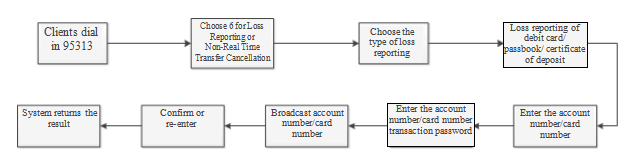

Ø Only temporary loss reporting can be handled for passbook and debit card. The validity period of the temporary loss reporting is 5 days. After the validity period, the loss reporting will be automatically cancelled. Clients can bring the original valid ID card to the counter for formal loss reporting or cancellation within the validity period.

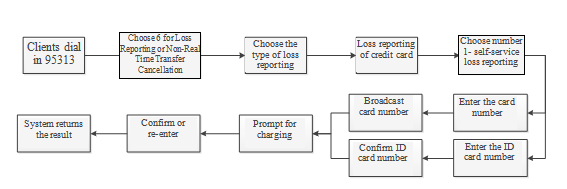

Ø The loss reporting of the credit card will take effect immediately after the formal loss reporting. After the lost credit card is reported, you can apply for re-issuing such card.

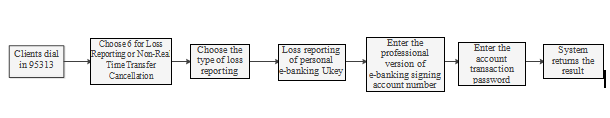

Ø The loss reporting of personal e-banking UKEY will take effect immediately after the lost UKEY is reported. Clients can bring the original valid ID card to the counter to re-apply for personal e-banking UKEY.

Operation Process

Clients can report the loss through self-service voice service or manual service.

If manual service is needed, dial in 95313 and choose “6 - Loss Reporting or Non-Real Time Transfer Cancellation → 0 - manual service”.

If you wish to report the loss through self-service voice service system, please refer to the following operation process:

★ Loss reporting of debit card/passbook/certificate of deposit:

★ Loss reporting of credit card:

★ Loss reporting of personal e-banking Ukey: